Embark on a journey to discover the most efficient ways to shop for car insurance quotes online. With a plethora of information and tips awaiting you, this guide aims to simplify the process and help you make informed decisions.

Researching Car Insurance Quotes Online

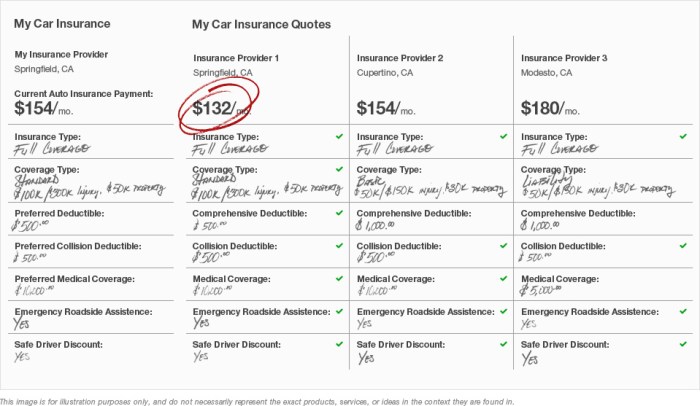

When it comes to finding the best car insurance policy for your needs, researching multiple car insurance quotes online is crucial. By comparing quotes from different providers, you can ensure that you are getting the best coverage at the most competitive price.

Where to Find Reliable Sources for Car Insurance Quotes Online

- Visit insurance comparison websites: Websites like Compare.com or NerdWallet allow you to compare quotes from multiple insurance companies in one place.

- Check insurance company websites: Many insurance providers offer online quote tools on their websites, making it easy to get an estimate of their rates.

- Utilize independent agents: Independent insurance agents can help you gather quotes from various companies and provide expert advice on choosing the right policy.

Factors to Consider When Comparing Quotes from Different Providers

- Coverage options: Make sure to compare the coverage limits, deductibles, and types of coverage offered by each provider.

- Price: While cost is important, it's also essential to consider the value you're getting for the price you pay.

- Customer reviews: Check online reviews and ratings for each insurance company to get an idea of their customer service and claims handling.

- Discounts: Look for discounts that may apply to you, such as safe driver discounts or bundling discounts for insuring multiple vehicles.

Understanding Coverage Options

When shopping for car insurance, it's essential to understand the different coverage options available to ensure you have adequate protection in case of an accident or other unforeseen events.

Types of Coverage

- Liability Coverage: This covers costs associated with injuries or property damage you cause to others in an accident.

- Collision Coverage: This pays for damage to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive Coverage: This covers damage to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers regardless of fault in an accident.

Significance of Limits and Deductibles

Understanding coverage limits and deductibles is crucial as they directly impact the cost and extent of coverage you receive. Coverage limits refer to the maximum amount your insurance will pay for a claim, while deductibles are the amount you must pay out of pocket before your insurance kicks in.

Impact on Insurance Premiums

Choosing different coverage options can significantly impact your insurance premiums. For example, opting for higher coverage limits or lower deductibles will typically result in higher premiums, while selecting lower coverage limits or higher deductibles can lower your premiums but may leave you more financially vulnerable in the event of a claim.

Utilizing Comparison Tools

Comparison tools play a vital role in helping individuals efficiently shop for car insurance quotes online. These tools allow users to easily compare multiple quotes from different insurance providers, saving time and effort in the process. By utilizing comparison tools effectively, individuals can find the best coverage at a competitive price.

Comparing Different Online Platforms

- Some popular online platforms that offer car insurance quote comparisons include Compare.com, NerdWallet, and The Zebra.

- Each platform has its unique features, such as user-friendly interfaces, a wide range of insurance providers, and personalized quote options.

- Users can input their information once and receive multiple quotes from various insurance companies, making it easier to compare rates and coverage options.

Using Comparison Tools Effectively

- Start by entering accurate information about your vehicle, driving history, and coverage preferences into the comparison tool.

- Review the quotes provided, paying attention to coverage limits, deductibles, and any additional features or discounts offered.

- Consider factors such as customer reviews, financial stability of the insurance companies, and the ease of filing claims when comparing quotes.

- Use filters or sorting options available on the comparison tool to refine your search and focus on the quotes that best meet your needs.

- Take advantage of any tools or calculators offered to estimate premiums based on different coverage levels or policy options.

Evaluating Customer Reviews and Ratings

When shopping for car insurance, considering customer reviews and ratings can provide valuable insights into the experiences of other policyholders. Evaluating feedback from current or past customers can help you make informed decisions and choose a reputable insurance provider that meets your needs.

Importance of Customer Reviews

Customer reviews offer firsthand accounts of interactions with insurance companies, giving you a glimpse into their customer service, claims process, and overall satisfaction. By analyzing these reviews, you can assess the reliability and trustworthiness of insurance providers.

- Look for patterns: Pay attention to recurring themes or common feedback in reviews to identify strengths and weaknesses of insurance companies.

- Consider overall ratings: Take into account the overall rating of an insurance provider based on customer reviews to gauge their quality of service.

- Evaluate specific feedback: Read detailed reviews to understand specific experiences and concerns raised by customers, helping you anticipate potential issues.

Interpreting Customer Feedback

Interpreting customer reviews requires a critical eye to distinguish between genuine feedback and biased opinions. Consider the following tips when evaluating customer feedback to make informed decisions:

- Verify credibility: Check if reviews come from verified customers or reputable sources to ensure authenticity.

- Consider the context: Understand the circumstances behind each review to contextualize feedback and make fair judgments.

- Look for consistency: Focus on consistent feedback across multiple reviews to validate claims and form a well-rounded perspective.

Identifying Reliable Sources

Finding reliable sources for customer reviews is crucial to gather trustworthy information about insurance providers. Follow these tips to identify reputable platforms for customer feedback:

- Use independent review sites: Consult independent review websites that aggregate feedback from multiple sources to provide unbiased reviews.

- Check social media platforms: Explore social media channels for customer testimonials and reviews, offering real-time insights into insurance companies.

- Seek recommendations: Ask for recommendations from family, friends, or online communities to discover reputable sources for customer reviews.

Epilogue

In conclusion, mastering the art of shopping for car insurance quotes online can lead to significant savings and optimal coverage. Take charge of your insurance decisions by utilizing the knowledge and tools provided in this guide.

FAQ Section

How important is it to research multiple car insurance quotes online?

Researching multiple quotes is crucial as it allows you to compare prices, coverage options, and find the best deal that suits your needs and budget.

What are some common types of coverage offered in car insurance policies?

Common types of coverage include liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

How do comparison tools help in shopping for car insurance quotes online?

Comparison tools streamline the process by providing multiple quotes from different insurers in one place, making it easier to compare and choose the best option.

Why is it essential to consider customer reviews and ratings when shopping for car insurance?

Customer reviews and ratings offer insights into the quality of service provided by insurance companies, helping you make an informed decision based on others' experiences.