Exploring the intricacies of What Makes a Great Auto Policy Quote? Expert Insights, this introduction sets the stage for a detailed discussion on the topic, providing valuable insights and information in a captivating manner.

The following paragraphs will delve into the key components, factors, coverage options, customization, and fine print details of auto policy quotes, offering a comprehensive understanding for readers.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding policy quotes is essential for making informed decisions. An auto policy quote is an estimate provided by an insurance company detailing the coverage options and cost for insuring your vehicle.

Key Components of an Auto Policy Quote

- The coverage types: This includes liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Deductibles: The amount you must pay out of pocket before your insurance kicks in.

- Limits: The maximum amount your insurance will pay for a covered claim.

- Add-ons or endorsements: Optional coverages that you can add to enhance your policy.

- Premium: The cost you pay for the insurance policy, either monthly, semi-annually, or annually.

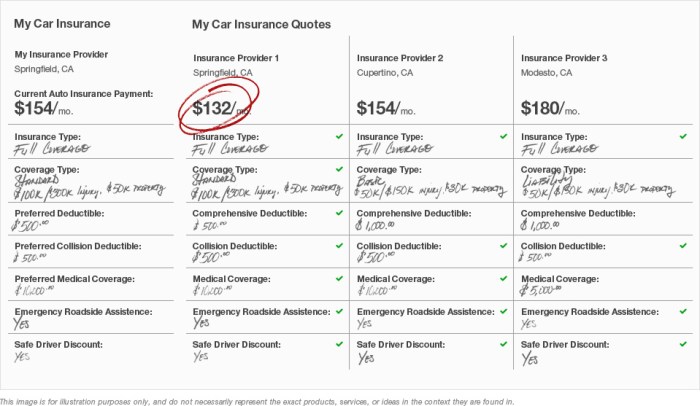

Importance of Obtaining Multiple Quotes

Shopping for auto insurance can be overwhelming, but obtaining multiple quotes is crucial for finding the best coverage at the most competitive price. By getting quotes from different insurance companies, you can compare coverage options, premiums, and discounts to ensure you are getting the most value for your money.

Factors Influencing a Great Auto Policy Quote

When it comes to getting a great auto policy quote, several factors come into play that can significantly impact the cost. Understanding these factors is crucial for drivers looking to secure the best possible deal on their auto insurance.The type of vehicle you drive and how you use it are key factors that insurance companies consider when providing a quote.

More expensive or high-performance vehicles may come with higher insurance premiums due to the increased cost of repairs or replacement. Additionally, how you use your vehicle, such as for commuting or leisure, can affect the quote as well.

Type of Vehicle and Usage

The make and model of your vehicle, as well as its age and safety features, can all influence the cost of your auto policy quote. Newer vehicles with advanced safety technology may be eligible for discounts, while older vehicles without these features could result in higher premiums.

Furthermore, if you use your vehicle for business purposes or long commutes, your insurance rates may be higher compared to someone who only uses their car occasionally for personal reasons.

Driver's Age, Driving History, and Location

The driver's age, driving history, and location are also significant factors that insurers take into account when calculating auto policy quotes. Younger drivers, especially teenagers, typically face higher premiums due to their lack of driving experience and higher likelihood of accidents.

On the other hand, older drivers with a clean driving record may qualify for lower rates.Additionally, where you live can impact your auto insurance costs. Urban areas with higher rates of accidents or vehicle thefts may result in higher premiums compared to rural areas with lower risk factors.

Your ZIP code can play a role in determining your quote, as insurance companies assess the likelihood of claims based on the location of your residence.

Coverage Options in Auto Policy Quotes

When it comes to auto policy quotes, there are various coverage options available to suit different needs and situations. Understanding the benefits of each coverage option can help you make an informed decision when selecting your auto insurance policy.

Liability Coverage

Liability coverage is essential in any auto policy quote as it helps cover costs associated with injuries or property damage that you are legally responsible for in an accident. This coverage protects you from having to pay out of pocket for damages caused to others.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it's damaged in a collision with another vehicle or object. This coverage is especially beneficial if you have a newer car that would require expensive repairs in case of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. This coverage is valuable for those looking to protect their vehicle from a wide range of potential risks.

Uninsured/Underinsured Motorist Coverage

This coverage option protects you in case you are involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage to pay for the damages. Uninsured/Underinsured Motorist Coverage ensures that you are not left with hefty expenses due to someone else's lack of insurance.

Customizing Auto Policy Quotes

When it comes to auto policy quotes, customization is key in ensuring that the coverage meets your specific needs and preferences. Policyholders have the flexibility to tailor their quotes by adding or removing coverage options, adjusting deductibles, and setting coverage limits according to their requirements.

Adding or Removing Coverage Options

Policyholders can customize their auto policy quotes by selecting the coverage options that are most relevant to them. This may include options such as comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and personal injury protection. By adding or removing these options, policyholders can create a policy that aligns with their individual needs and budget.

Adjusting Deductibles and Coverage Limits

Another way to customize an auto policy quote is by adjusting deductibles and coverage limits. Deductibles represent the amount of money a policyholder is required to pay out of pocket before their insurance coverage kicks in. By choosing a higher deductible, policyholders can lower their premiums.

Similarly, adjusting coverage limits allows policyholders to set the maximum amount their insurance will pay out in the event of a claim, giving them greater control over their policy's scope and cost.

Understanding Fine Print and Exclusions

When reviewing an auto policy quote, it is crucial to pay close attention to the fine print and exclusions. These details can significantly impact the coverage and benefits you receive in case of an accident or claim. Here, we will delve into common fine print details and exclusions found in auto policy quotes and provide tips on how to navigate them effectively.

Common Fine Print Details

- Policy Term and Renewal Conditions: The fine print often Artikels the duration of the policy, renewal terms, and any conditions associated with extending coverage.

- Claim Procedures: Details on how to file a claim, required documentation, and time limits for reporting incidents are usually included in the fine print.

- Policy Limits and Deductibles: Specific limits on coverage amounts and deductibles for different types of claims are typically mentioned in this section.

- Coverage Exclusions: Certain situations or types of damage may be excluded from coverage, such as intentional acts or driving under the influence.

Exclusions in Auto Policy Quotes

- Wear and Tear: Damage resulting from regular wear and tear or lack of maintenance may not be covered by the auto policy.

- Racing or Illegal Activities: Accidents that occur while engaging in racing or illegal activities may be excluded from coverage.

- Unlisted Drivers: If an accident happens while someone not listed on the policy is driving the insured vehicle, it might not be covered.

- Excluded Vehicles: Some policies exclude coverage for specific types of vehicles, such as motorcycles or commercial vehicles.

Tips for Understanding Fine Print

- Read Carefully: Take the time to read through the fine print of the auto policy quote thoroughly to understand all terms and conditions.

- Ask Questions: If you are unsure about any details or exclusions, don't hesitate to ask your insurance agent for clarification.

- Compare Quotes: Compare multiple auto policy quotes to see how exclusions and fine print details vary between different insurance providers.

- Seek Legal Advice: If you encounter complex legal language or terms you do not understand, consider seeking advice from a legal professional.

Closing Notes

In conclusion, What Makes a Great Auto Policy Quote? Expert Insights sheds light on the nuances of obtaining an ideal auto insurance quote, empowering individuals to make informed decisions when selecting the best policy for their needs.

User Queries

What factors can impact the cost of an auto policy quote?

Factors such as the type of vehicle, driving history, and location can significantly influence the cost of an auto policy quote.

How can policyholders customize their auto policy quotes?

Policyholders can customize their quotes by adjusting deductibles, coverage limits, and adding or removing specific coverage options to tailor the policy to their needs.

What are common exclusions mentioned in auto policy quotes?

Exclusions like pre-existing damage, intentional acts, and certain types of vehicles may be mentioned in auto policy quotes, so it's crucial for policyholders to understand these limitations.

Exploring the intricacies of What Makes a Great Auto Policy Quote? Expert Insights, this introduction sets the stage for a detailed discussion on the topic, providing valuable insights and information in a captivating manner.

The following paragraphs will delve into the key components, factors, coverage options, customization, and fine print details of auto policy quotes, offering a comprehensive understanding for readers.

Understanding Auto Policy Quotes

When it comes to auto insurance, understanding policy quotes is essential for making informed decisions. An auto policy quote is an estimate provided by an insurance company detailing the coverage options and cost for insuring your vehicle.

Key Components of an Auto Policy Quote

- The coverage types: This includes liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection.

- Deductibles: The amount you must pay out of pocket before your insurance kicks in.

- Limits: The maximum amount your insurance will pay for a covered claim.

- Add-ons or endorsements: Optional coverages that you can add to enhance your policy.

- Premium: The cost you pay for the insurance policy, either monthly, semi-annually, or annually.

Importance of Obtaining Multiple Quotes

Shopping for auto insurance can be overwhelming, but obtaining multiple quotes is crucial for finding the best coverage at the most competitive price. By getting quotes from different insurance companies, you can compare coverage options, premiums, and discounts to ensure you are getting the most value for your money.

Factors Influencing a Great Auto Policy Quote

When it comes to getting a great auto policy quote, several factors come into play that can significantly impact the cost. Understanding these factors is crucial for drivers looking to secure the best possible deal on their auto insurance.The type of vehicle you drive and how you use it are key factors that insurance companies consider when providing a quote.

More expensive or high-performance vehicles may come with higher insurance premiums due to the increased cost of repairs or replacement. Additionally, how you use your vehicle, such as for commuting or leisure, can affect the quote as well.

Type of Vehicle and Usage

The make and model of your vehicle, as well as its age and safety features, can all influence the cost of your auto policy quote. Newer vehicles with advanced safety technology may be eligible for discounts, while older vehicles without these features could result in higher premiums.

Furthermore, if you use your vehicle for business purposes or long commutes, your insurance rates may be higher compared to someone who only uses their car occasionally for personal reasons.

Driver's Age, Driving History, and Location

The driver's age, driving history, and location are also significant factors that insurers take into account when calculating auto policy quotes. Younger drivers, especially teenagers, typically face higher premiums due to their lack of driving experience and higher likelihood of accidents.

On the other hand, older drivers with a clean driving record may qualify for lower rates.Additionally, where you live can impact your auto insurance costs. Urban areas with higher rates of accidents or vehicle thefts may result in higher premiums compared to rural areas with lower risk factors.

Your ZIP code can play a role in determining your quote, as insurance companies assess the likelihood of claims based on the location of your residence.

Coverage Options in Auto Policy Quotes

When it comes to auto policy quotes, there are various coverage options available to suit different needs and situations. Understanding the benefits of each coverage option can help you make an informed decision when selecting your auto insurance policy.

Liability Coverage

Liability coverage is essential in any auto policy quote as it helps cover costs associated with injuries or property damage that you are legally responsible for in an accident. This coverage protects you from having to pay out of pocket for damages caused to others.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if it's damaged in a collision with another vehicle or object. This coverage is especially beneficial if you have a newer car that would require expensive repairs in case of an accident.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, natural disasters, or hitting an animal. This coverage is valuable for those looking to protect their vehicle from a wide range of potential risks.

Uninsured/Underinsured Motorist Coverage

This coverage option protects you in case you are involved in an accident with a driver who doesn't have insurance or doesn't have enough coverage to pay for the damages. Uninsured/Underinsured Motorist Coverage ensures that you are not left with hefty expenses due to someone else's lack of insurance.

Customizing Auto Policy Quotes

When it comes to auto policy quotes, customization is key in ensuring that the coverage meets your specific needs and preferences. Policyholders have the flexibility to tailor their quotes by adding or removing coverage options, adjusting deductibles, and setting coverage limits according to their requirements.

Adding or Removing Coverage Options

Policyholders can customize their auto policy quotes by selecting the coverage options that are most relevant to them. This may include options such as comprehensive coverage, collision coverage, uninsured/underinsured motorist coverage, and personal injury protection. By adding or removing these options, policyholders can create a policy that aligns with their individual needs and budget.

Adjusting Deductibles and Coverage Limits

Another way to customize an auto policy quote is by adjusting deductibles and coverage limits. Deductibles represent the amount of money a policyholder is required to pay out of pocket before their insurance coverage kicks in. By choosing a higher deductible, policyholders can lower their premiums.

Similarly, adjusting coverage limits allows policyholders to set the maximum amount their insurance will pay out in the event of a claim, giving them greater control over their policy's scope and cost.

Understanding Fine Print and Exclusions

When reviewing an auto policy quote, it is crucial to pay close attention to the fine print and exclusions. These details can significantly impact the coverage and benefits you receive in case of an accident or claim. Here, we will delve into common fine print details and exclusions found in auto policy quotes and provide tips on how to navigate them effectively.

Common Fine Print Details

- Policy Term and Renewal Conditions: The fine print often Artikels the duration of the policy, renewal terms, and any conditions associated with extending coverage.

- Claim Procedures: Details on how to file a claim, required documentation, and time limits for reporting incidents are usually included in the fine print.

- Policy Limits and Deductibles: Specific limits on coverage amounts and deductibles for different types of claims are typically mentioned in this section.

- Coverage Exclusions: Certain situations or types of damage may be excluded from coverage, such as intentional acts or driving under the influence.

Exclusions in Auto Policy Quotes

- Wear and Tear: Damage resulting from regular wear and tear or lack of maintenance may not be covered by the auto policy.

- Racing or Illegal Activities: Accidents that occur while engaging in racing or illegal activities may be excluded from coverage.

- Unlisted Drivers: If an accident happens while someone not listed on the policy is driving the insured vehicle, it might not be covered.

- Excluded Vehicles: Some policies exclude coverage for specific types of vehicles, such as motorcycles or commercial vehicles.

Tips for Understanding Fine Print

- Read Carefully: Take the time to read through the fine print of the auto policy quote thoroughly to understand all terms and conditions.

- Ask Questions: If you are unsure about any details or exclusions, don't hesitate to ask your insurance agent for clarification.

- Compare Quotes: Compare multiple auto policy quotes to see how exclusions and fine print details vary between different insurance providers.

- Seek Legal Advice: If you encounter complex legal language or terms you do not understand, consider seeking advice from a legal professional.

Closing Notes

In conclusion, What Makes a Great Auto Policy Quote? Expert Insights sheds light on the nuances of obtaining an ideal auto insurance quote, empowering individuals to make informed decisions when selecting the best policy for their needs.

User Queries

What factors can impact the cost of an auto policy quote?

Factors such as the type of vehicle, driving history, and location can significantly influence the cost of an auto policy quote.

How can policyholders customize their auto policy quotes?

Policyholders can customize their quotes by adjusting deductibles, coverage limits, and adding or removing specific coverage options to tailor the policy to their needs.

What are common exclusions mentioned in auto policy quotes?

Exclusions like pre-existing damage, intentional acts, and certain types of vehicles may be mentioned in auto policy quotes, so it's crucial for policyholders to understand these limitations.