Shop Car Insurance Quotes to Get Better Premium Rates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

Exploring the nuances of car insurance quotes can lead to substantial savings and better coverage options, making it a crucial aspect of financial planning for vehicle owners.

Why Shop Car Insurance Quotes?

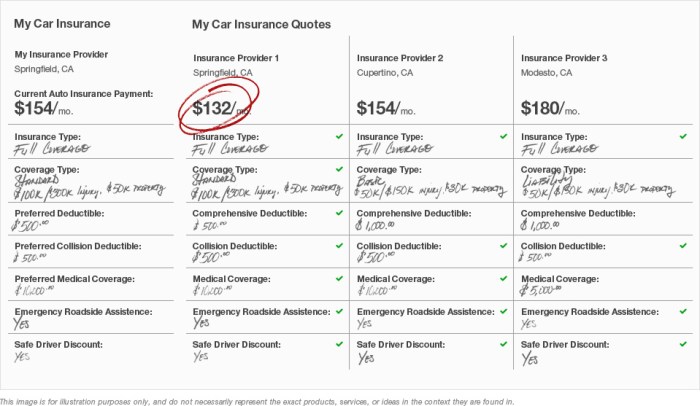

When it comes to getting the best deal on car insurance, shopping around for quotes is essential. This process allows you to compare different options and find the most competitive rates that suit your needs and budget.

Importance of Comparing Quotes

By exploring various car insurance quotes, you can uncover potential savings and discounts that may not be initially apparent. Insurance providers offer different rates based on factors such as your driving record, age, and the type of coverage you need.

Comparing quotes helps you identify the most cost-effective option available.

Benefits of Exploring Different Options

- Access to Competitive Rates: By obtaining quotes from multiple insurers, you can leverage competition in the market to secure better premium rates.

- Customized Coverage: Each insurance provider offers unique coverage options and add-ons. By comparing quotes, you can tailor your policy to meet your specific requirements.

- Better Understanding of Coverage: Exploring different insurance options allows you to gain a comprehensive understanding of the coverage available, enabling you to make an informed decision.

- Potential for Discounts: Insurance companies may offer discounts for various reasons, such as bundling policies or having a clean driving record. By shopping around, you can take advantage of these potential savings.

Factors Influencing Premium Rates

When it comes to car insurance premium rates, several factors come into play that can significantly impact how much you pay for coverage. Understanding these key factors is essential when shopping for car insurance quotes to ensure you get the best rates possible.

Personal Information and Driving History

Insurers take into account personal information such as age, gender, marital status, and credit score when calculating premium rates. Additionally, your driving history, including any past accidents, traffic violations, or claims, can also affect the cost of your insurance.

Type of Coverage

The type of coverage you choose can have a direct impact on your premium rates. Comprehensive coverage that includes protection against a wide range of risks will generally cost more than basic liability coverage.

Age, Location, and Type of Vehicle

Age is a significant factor in determining insurance rates, as younger drivers are considered higher risk and may face higher premiums. Your location can also influence rates, with urban areas typically having higher insurance costs due to increased traffic and crime rates.

The type of vehicle you drive, including its make, model, and safety features, can also impact insurance costs.

How to Shop for Car Insurance Quotes

When looking to shop for car insurance quotes, it's important to follow a systematic approach to ensure you get the best premium rates. Here is a step-by-step guide on how to effectively shop for car insurance quotes:

Where to Look for Quotes

- Online Comparison Websites: Utilize online platforms that allow you to compare multiple insurance quotes from different providers in one place. This can save you time and effort in your search.

- Directly from Insurance Companies: Visit the websites of individual insurance companies to get quotes tailored to your specific needs. This can help you get a more accurate estimate based on your personal details.

Tips for Comparing Quotes

- Ensure Consistency: Provide the same information and coverage details when requesting quotes to make accurate comparisons.

- Review Coverage Options: Look beyond the premium rates and consider the coverage options provided by each insurance quote. Make sure you understand what is included and excluded in the policy.

- Check for Discounts: Inquire about any discounts or promotions that may be available to you based on your driving history, age, or other qualifying factors. This can help lower your premium rates.

- Read Customer Reviews: Research the reputation of the insurance companies offering quotes to ensure they have a history of good customer service and quick claims processing.

- Consider Customer Support: Evaluate the customer support services provided by each insurance company, as this can be crucial in case you need to file a claim or have any questions about your policy.

Understanding Coverage Options

When it comes to car insurance, understanding the different coverage options available is crucial in making informed decisions that can impact your premium rates. Each type of coverage offers protection for different aspects of your vehicle and driving experience. Let's delve into the details of various coverage options to help you choose the right one for your needs.

Liability Coverage

Liability coverage is essential and often required by law. It helps cover costs associated with injuries or property damage you may cause to others in an accident where you are at fault.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if you're involved in a collision with another vehicle or object, regardless of who is at fault.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damages not caused by a collision, such as theft, vandalism, or natural disasters.

Uninsured/Underinsured Motorist Coverage

This coverage helps protect you if you're involved in an accident with a driver who doesn't have insurance or enough insurance to cover your expenses.

Personal Injury Protection

Personal Injury Protection (PIP) covers medical expenses for injuries sustained by you or your passengers, regardless of fault.

Choosing the Right Coverage

Choosing the right coverage options based on your driving habits, the value of your vehicle, and your financial situation can help you get better premium rates. It's important to assess your needs and risks to determine the most suitable coverage for your car insurance policy.

Final Wrap-Up

In conclusion, delving into the world of car insurance quotes unveils a realm of possibilities for securing optimal coverage at the best possible rates. By understanding the intricacies of premium rates and coverage options, individuals can make informed decisions that align with their needs and budget.

FAQ Overview

Why is shopping for car insurance quotes important?

Shopping around allows individuals to compare rates from different providers and find the best deal that suits their needs and budget.

What factors influence car insurance premium rates?

Personal information, driving history, type of coverage, age, location, and vehicle type all play a role in determining premium rates.

How can I shop for car insurance quotes effectively?

Use online comparison websites or contact insurance companies directly, compare quotes accurately, and consider all coverage options to find the best rates.

What are the different types of coverage options in car insurance?

Liability, collision, comprehensive, and other types of coverage offer varying degrees of protection, impacting premium rates accordingly.