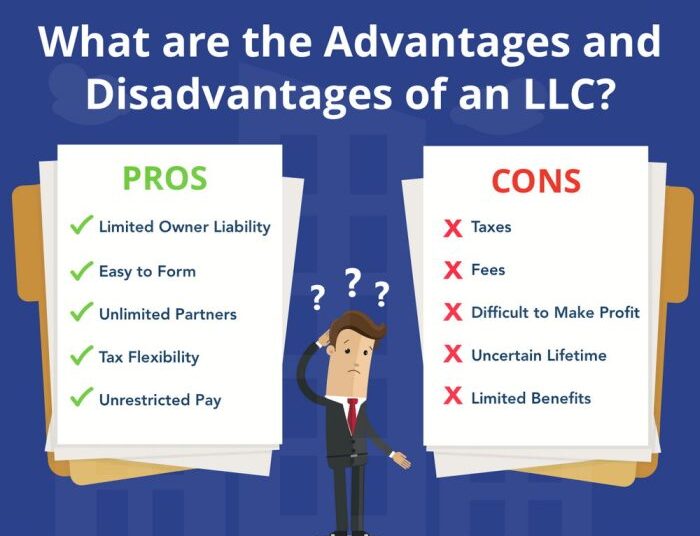

Exploring the significance of forming an LLC for design professionals, this introduction sets the stage for a detailed examination of the topic. It delves into the various aspects that make this business structure essential for professionals in the design industry.

Providing insights into the benefits and advantages of establishing an LLC, this discussion aims to inform and educate design professionals on the importance of this decision.

Importance of LLC for Design Professionals

Design professionals, such as graphic designers, architects, and interior designers, can benefit greatly from forming a Limited Liability Company (LLC) for their business. An LLC provides legal protection and separation between personal assets and business liabilities, offering various advantages that can safeguard design professionals in their industry.

Protection for Design Professionals

- Forming an LLC can protect personal assets, such as savings, property, and investments, from being used to cover business debts or legal claims.

- Design professionals are shielded from personal liability for business obligations, meaning their personal assets are generally not at risk in case of lawsuits or financial troubles within the business.

Legal Benefits of an LLC

- LLCs offer limited liability protection, which means that the owners (members) are not personally responsible for the debts and liabilities of the business.

- Design professionals can enjoy pass-through taxation, where profits and losses are passed through to the owners' personal tax returns, potentially resulting in tax savings compared to other business structures.

Separation of Assets

- By establishing an LLC, design professionals can create a clear separation between personal and business assets, helping to maintain financial security and organization.

- This separation can also simplify tax reporting and financial management, making it easier to track business expenses and revenue without intermingling personal funds.

Tax Advantages of Forming an LLC

When it comes to tax advantages, forming an LLC can be highly beneficial for design professionals. Let's delve into the specifics of how an LLC can help design professionals save on taxes.

Tax Implications: Sole Proprietorship vs. LLC

Operating as a sole proprietorship means that all business income is considered personal income, subject to self-employment taxes. On the other hand, forming an LLC allows design professionals to separate personal and business income, potentially reducing the overall tax burden.

Specific Tax Deductions for Design Professionals under an LLC

- Office expenses, including rent and utilities.

- Professional development and education costs.

- Cost of materials and supplies for design projects.

- Travel expenses related to client meetings or project installations.

- Health insurance premiums for self-employed individuals.

Saving on Self-Employment Taxes with an LLC

By structuring their design business as an LLC, professionals can choose to be taxed as a corporation, potentially reducing self-employment taxes. LLC members can also take advantage of tax deductions and credits not available to sole proprietors, ultimately leading to tax savings.

Liability Protection for Design Professionals

Forming an LLC can provide crucial protection for design professionals by separating personal assets from business liabilities. This separation helps shield personal finances and assets from being at risk in case of legal issues related to the business.

How an LLC Protects Design Professionals

- An LLC limits the personal liability of design professionals, meaning that if the business faces a lawsuit or debt, the personal assets of the owners are protected.

- For example, if a client sues a design professional for a mistake in a project, the liability would typically be limited to the assets of the LLC, rather than the personal assets of the individual.

The Importance of Liability Insurance

- While an LLC provides a level of protection, liability insurance is also crucial for design professionals to further safeguard against potential legal claims and expenses.

- Having liability insurance in conjunction with an LLC can help cover legal costs, settlements, and other liabilities that may arise from the design business.

Safeguarding Personal Assets

- In the event of business-related legal issues, an LLC can help protect the personal assets of design professionals, such as savings, real estate, and investments.

- By keeping personal and business finances separate through the LLC structure, design professionals can minimize the risk of losing their personal assets in case of lawsuits or debts.

Flexibility and Growth Opportunities with an LLC

Forming an LLC provides design professionals with a range of flexibility and growth opportunities that can help them adapt to changing business needs and expand their operations.

Management and Ownership Flexibility

- LLCs offer flexibility in management structure, allowing design professionals to choose between member-managed or manager-managed options based on their preferences.

- Ownership interests in an LLC can be easily transferred or distributed among members, providing a seamless way to bring in new partners or investors.

Adding Partners or Members

- Design professionals can easily add partners or members to their LLC by amending the operating agreement and filing the necessary paperwork with the state.

- This flexibility enables businesses to bring in new expertise, capital, or resources to support growth and expansion.

Adapting to Changing Business Needs

- An LLC structure allows design professionals to modify the operating agreement to accommodate changes in business goals, ownership structure, or management responsibilities.

- Design professionals can pivot their business focus, scale operations, or introduce new services without the constraints of a rigid business structure.

Credibility and Professional Image

- Forming an LLC can enhance the credibility and professional image of design professionals in the eyes of clients, partners, and stakeholders.

- Clients may perceive an LLC as a more established and trustworthy business entity, which can lead to increased opportunities for collaboration and growth.

End of Discussion

In conclusion, the formation of an LLC offers design professionals a solid foundation for growth, protection, and flexibility in their business endeavors. By understanding the key aspects highlighted in this discussion, professionals in the design industry can make informed decisions that contribute to their long-term success.

Question & Answer Hub

Is forming an LLC only beneficial for large design firms?

No, forming an LLC is beneficial for design professionals of all sizes as it offers legal protection and tax advantages regardless of the scale of the business.

Can an LLC protect personal assets in case of a lawsuit against the business?

Yes, one of the key benefits of an LLC is that it helps shield personal assets from business-related liabilities, providing an extra layer of protection for design professionals.

Are there any specific tax deductions available to design professionals operating under an LLC structure?

Yes, design professionals under an LLC may be eligible for deductions related to business expenses, equipment purchases, and other operational costs, helping them save on taxes.